If a five-year probe of California businesses is any guide, a substantial number of U.S. restaurants are using high-tech methods to skip out on taxes.

“Zappers,” illegal software applications used by unscrupulous business owners to evade sales and income taxes, were found in nearly a fifth of California restaurants during a five-year audit initiative, state revenue officials say.

Despite the extensive use of zappers, fewer than 1% of restaurant owners found with the illegal software faced state criminal charges. Under California’s sales and use tax code, any person purchasing, installing, or using automated sales suppression devices or software is guilty of a misdemeanor, punishable by up to three years in prison and $10,000 in fines per offense.

The California Department of Tax & Fee Administration conducted audits of 2,197 restaurants between 2014 and 2019 and specifically examined each business’s point-of-sale system for the presence of sales-zapping devices or software. It found 410 taxpayers with sales suppression systems that violated California’s anti-zapper law, which became effective Jan. 1, 2014.

The audit results suggest 19% of audited California restaurants used zappers to hide some portion of their sales and profits from tax authorities. The department calculated the tax loss from such illegal conduct at more than $30 million during the five-year audit period.

The data mark the first time a state has released comprehensive results of its efforts to curb fraud linked to sales suppression techniques in their point of sales (POS) systems. The information was provided to Bloomberg Tax following an open records demand on the department for tax enforcement data.

That 19% penetration rate likely understates the true volume of zapper crimes, said Richard Ainsworth, an adjunct professor at New York University School of Law and an authority on tax fraud.

“There was probably more out there, and they just didn’t find them,” Ainsworth said. “There are restaurants that know how to cover it up. Or the restaurant had a different kind of POS system that the auditor didn’t understand. Auditors are unintentionally biased toward what they can find easily. It’s not their fault because they have limited resources, and they don’t have the right technical knowledge.”

Erasing Transactions

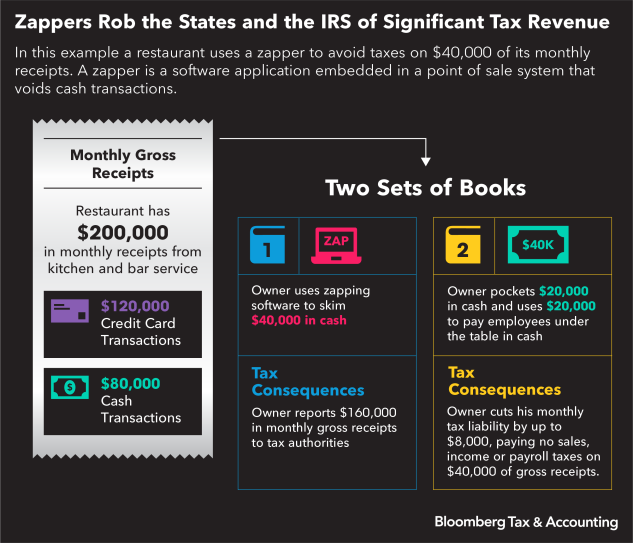

Zapper systems, operating from a memory stick, removable disk, or internet connection, allow a business to zap, or delete, selected sales. They then recalculate individual receipts and the taxes due. The most sophisticated systems can reconcile differences with the restaurant’s other financial records to hide evidence of the fraud.

With zapping, businesses reduce their overall exposure to state and local sales taxes, local restaurant excise taxes, and state and federal income taxes. In cases where the restaurant owner uses the cash to pay employees under the table, the business may also violate payroll tax rules. A recent Bloomberg Tax report revealed that tax losses due to zappers and skimming are costing the states and the federal government up to $30 billion annually.

Warren Klomp, director of CDTFA’s cannabis sales and sales suppression division, cautioned against drawing any “statewide conclusions.”

The data, gathered from audits in a pilot investigation, don’t represent a complete picture of the prevalence of zappers in California’s food and drink industry, Klomp said. For instance, the pilot focused primarily on businesses located in the Los Angeles and San Francisco metropolitan areas. In addition, the pilot only looked at restaurants with point-of-sale systems, leaving out audits of restaurants relying on basic electronic cash registers, and paper-based billing and accounting systems.

The vast majority of the 410 restaurants identified for tax zapping have entered settlements with the state. Such settlements require the defendants to remit back taxes, interest, and penalties of up to 25% of the underpayment, said CDTFA spokeswoman Tamma Adamek.

The five largest resolutions brought nearly $4 million into state coffers, she said. In the largest settlement, a restaurant paid $1.2 million to resolve its compliance failures.

PODCAST: Sales-Hiding Software Outsmarts U.S. Tax Collectors

Criminal Cases

California levied criminal charges against just four individuals from its list of 410 businesses found with zappers. Evidence developed in another 17 audits, however, might lead eventually to criminal charges, Adamek said.

Under the terms of one plea agreement, a restaurant operator must pay restitution of $1.54 million and faces a maximum prison sentence of more than nine years. A sentencing hearing will be held at the end of September. The restaurant operator in a separate case agreed to pay $1.37 million in restitution and faces a maximum prison term of more than six years. A sentencing hearing will be held next year.

The relatively small number of criminal zapper cases reflects the problems enforcement agencies encounter when dealing with a technology designed to intentionally obscure a business’s accounts, Adamek said.

“It can be tough to get a complete set of records showing a pattern of them doing sales suppression, and that’s required for a criminal case, as opposed to some administrative step we would take against them,” she said.

Moreover, CDTFA simply doesn’t have the resources or the desire to criminally prosecute large numbers of restaurants, particularly when the industry has been brutalized by the Covid-19 pandemic, said David Klasing, an Irvine, Calif.-based tax attorney who has defended clients in zapper cases.

In a small number of situations CDTFA files criminal actions to “scare the rest of the herd into compliance,” he said. Generally, however, restaurant owners found with zappers and the department settle quickly to save the businesses.

“If I can close this down as a civil issue and prevent my client from going to jail, that’s a big win,” Klasing said. “And the numbers reflect it. When you say only four people went to jail and you’ve got 410 people using zappers, those numbers don’t surprise me at all. The government can’t criminally prosecute everyone they have evidence for.”