In case you’ve forgotten: WeWork is/was a company that rented co-working office space. It presented itself as a tech company and rode investment from Softbank to a $47 billion valuation. Eventually people woke up and realized that not only was WeWork not worth $47 billion, but that the corporate ownership structure gave insane levels of control to founder Adam Neumann who, in addition to being highly erratic, used this control to extract about $700 million from the company.1

As WeWork crashed and lost 93 percent of its value, its investors realized that the only way to prevent the company from going to zero was to get rid of Neumann. And so Neumann held the investors hostage and convinced them to pay him another $200 million just to go away.

Think about that for a minute: This asset, WeWork, will be worth $0.00 if its founder remains in control. But it might be worth slightly more than $0.00 if the founder leaves. So the bankers are going to pay this value-sink $200 million not for services rendered, but simply to disappear.

Yay, capitalism!

It gets worse. This $200 million payday will be on top of the $700 million dollars in phantom value that Neumann already extracted from the company before the rest of the market realized that WeWork was a sham. And it will be coming at nearly the same moment that WeWork lays off some 2,000 employees.

I don’t know anything about these workers. And I don’t know what sort of severance they’re getting, but I’m willing to bet that:

(1) None of these employees was such a negative value that their continued presence would have bankrupted the company, as Neumann’s was.

(2) None of them is going to be paid $200 million to stop doing something that’s killing the company.

But hey, this is how the cookie crumbles while you’re breaking eggs to make an omelette or whatever. The point is that capitalism in the aggregate makes everyone much better off than any other system. But in the specific can cause suboptimal, illogical, and/or unfair outcomes.

The trick of keeping a market-based economy intact under a democratic polity is to regulate around the edges so that the majority of people don’t become so disenchanted with the suboptimal, illogical, and unfair outcomes that they decide to junk the whole system.

And even if Adam Neumann got to profit from a market failure once, at least he’ll never be able to pull that kind of trick again.

Oopsie!

So here is the deal: Adam Neumann has a new company. It’s called “Flow” and like WeWork it puts a tech veneer on an existing category of business:

In an interview with the Financial Times trailing his plans in March, Neumann defined that crisis in terms of hard data and human longing.

The US is chronically short of homes, he said, and is not building new ones fast enough. Between 2018 and 2020 that shortage grew from 2.5mn homes to 3.8mn, the chief economist at US government-backed mortgage giant Freddie Mac estimates. A recent White House analysis noted that the number of new homes within reach of first-time buyers had fallen by 80 per cent since the 1970s. The Federal Reserve’s efforts to control inflation by pushing up interest rates are only making affordable housing more scarce.

As the laws of supply and demand push house prices up faster than salaries, Neumann said, a young cohort he once named the We Generation “are almost the R Generation because they need to rent”. So Neumann spent hundreds of millions of dollars buying rental apartment buildings in cities such as Austin, Miami, and Nashville, whose popularity among that demographic has only grown through the pandemic.

Walking through those buildings, he said, he saw a “tremendous” opportunity to make them more uplifting for tenants striving for a better quality of life: “It felt like there were better ways to operate the buildings. And it felt like, frankly, there’s room for more community.” . . .

This would include an app on which tenants could make payments and access amenities and events, according to a friend of Neumann.

Two of the buildings reportedly bought by Neumann point to the options already on offer. One in Nashville advertises a music room for jam sessions, a “bark park for pups” and “valet trash pick-up”. Another in Fort Lauderdale, Florida, lets tenants “live the lifestyle [they] deserve” with “rent-by-bedroom” co-living, an outdoor cinema and a “bumpy lawn art area”.

Congratulations. You’ve invented renovation.

Because of this crazy, outside-the-box thinking, the VC firm Andreessen-Horowitz has invested $350 million in Flow, giving the company a valuation of $1 billion.

Not that it matters, but Flow does not seem to have any customers or be generating any revenue yet? Here is the sum-total of the company’s website right now:

If you click the “Join Us” button, you can give Adam Neumann your email. I guess that’s worth a billion dollars.

Normally, I wouldn’t care about this. It’s not my money. If Andreessen-Horowitz wants to give Adam Neumann $350 million of its investors’ dollars, then so be it. That’s the free market.

But there is a “don’t piss on my leg and tell me it’s raining” aspect to this story. Here’s William Cohan:

After the extremely well-documented fleecing of investors perpetrated by Neumann and WeWork, it blows my mind that the braintrust behind a16z—the best in the business, right?—could possibly back Neumann again in this new venture. And not just with a toehold investment, but a nine-figure check, the largest the firm has ever written in its history. . . .

[Andreessen] even [goes] so far as to reframe the WeWork imbroglio as a value add. “Adam, and the story of WeWork, have been exhaustively chronicled, analyzed, and fictionalized—sometimes accurately,” Andreesen wrote on his blog. “For all the energy put into covering the story, it’s often underappreciated that only one person has fundamentally redesigned the office experience and led a paradigm-changing global company in the process: Adam Neumann. We understand how difficult it is to build something like this and we love seeing repeat-founders build on past successes by growing from lessons learned. For Adam, the successes and lessons are plenty and we are excited to go on this journey with him and his colleagues building the future of living.”

WeWork is a “past success” that provided valuable “lessons learned”? Apparently not for investors!

You know the old line about how if you owe the bank $1 million, then the bank owns you, but if you owe the bank $100 million, then you own the bank? Maybe there’s a VC analogue to that:

If you lose $40 million of VC money, then you’re a disgrace who will never convince people to invest in you again. But if you lose $40 billion of VC money, then you’re an eccentric genius and the world is your oyster.

Again: This is just capitalism. If Flow is a successful business, then Andreesen-Horowitz will make lots of money. If Flow fails, then the money Andressen-Horowitz put into it will make its way to other productive endeavors. (Either way, I suspect Adam Neumann will find a way to get paid.)

But the story of WeWork and Adam Neumann and now Flow is a pretty good example of one of capitalism’s suboptimal outcomes.

And a reminder that the rules that hold for normal people don’t apply to the very rich.

The Fed’s big hope has been to engineer a “soft landing” from the pandemic shocks which gave us an overheated economy, supply-chain problems, and inflation. What’a soft-landing? Imposing just enough pain to restore balance to the economy without triggering a recession.

Soft-landings are awfully hard to come by because (a) economic systems are too complex to be finely managed and (b) the Fed only has one tool.

But so far, so good?

Inflation decelerated last month even as job growth was exceptionally robust. Gas prices keep falling.

The Fed is meeting at Jackson Hole this week and on Friday Jerome Powell will speak. His remarks are expected to give some clue as to what the next Fed rate hike will be—whether they’ll tick up another 75 basis points or perhaps slow the rate raises and increase by 50 basis points.

I know it doesn’t fit with the current narrative, but all of this looks like competent leadership from the executive branch. The Fed has responded seriously to inflation. The president is not out there publicly brow-beating the Fed chairman (as the former president often did).

The system is working the way it’s supposed to. Not perfectly. But normally. There are no crazy, policy-shifting 1am tweets. There is no chaos.

What chaos does exist in American politics is still emanating from Trump and the Republican party.

And life—real life, for the average American—is pretty good. There are jobs aplenty. Fuel costs are way down. Inflation is easing. The president continues to do a good job managing the Ukraine crisis. Just about everyone who wants to be safe from the worse effects of COVID is living life normally.

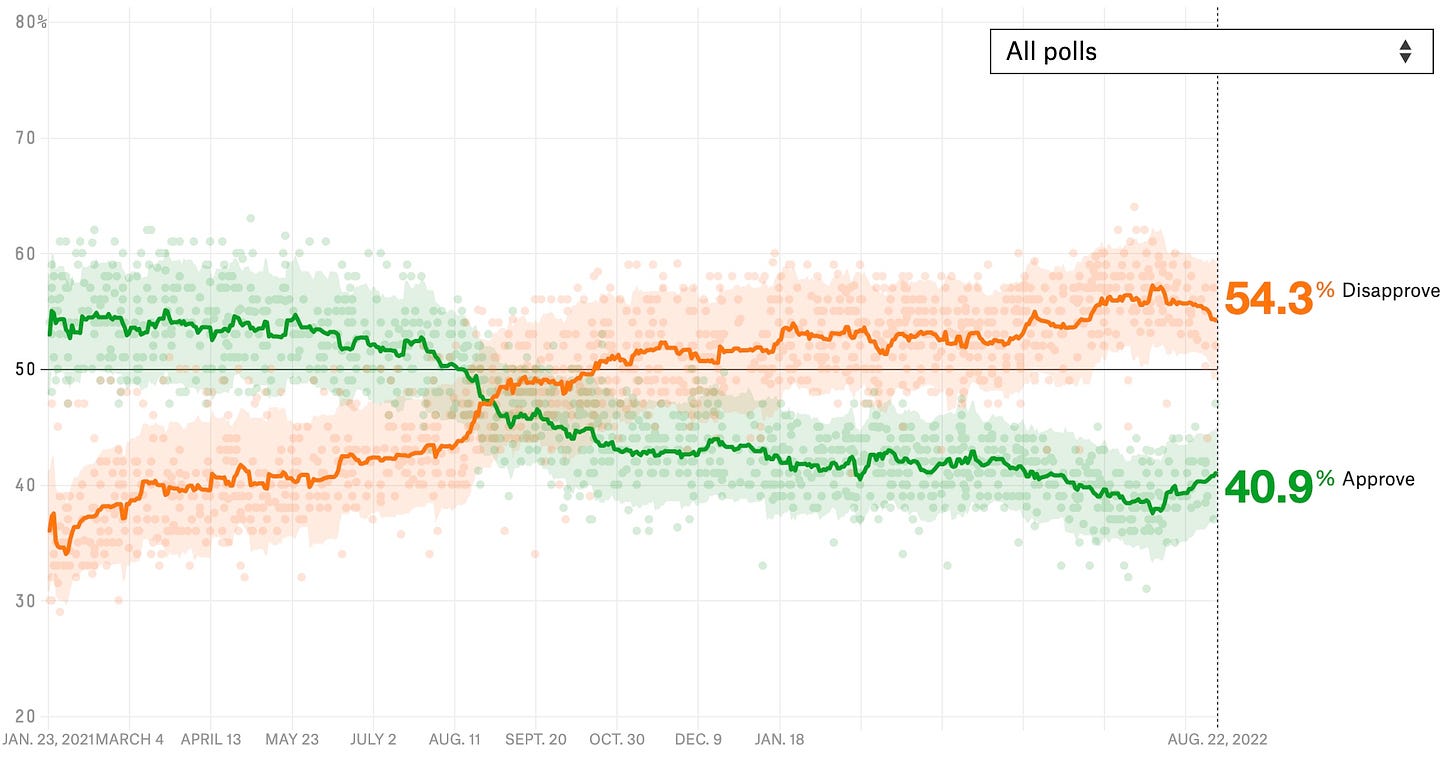

Presidential job approval ratings are lagging indicators, so for the above reasons, I expect to see Biden’s numbers improve over the next several weeks. You can already see the trend beginning:

Why? Because when Biden hit his nadir of 37 percent approval, it meant that lots of Democrats and Biden voters had soured on him. I suspect many of those voters will be coming home over the 12 weeks if the economic situation continues to stabilize. Just getting Democrats back on side should be enough to get Biden to at least 42 percent approval.

A month ago we thought that the midterms would take place in an environment in which Biden was at a net -20 approval. Instead, they may happen in a net -10 environment. Which would make for a big change even without taking into account Republican candidate quality.

This piece about a billionaire owner killing a newspaper hit awfully close to home. I’m going to give you just one line to sum it all up, in the hopes that you’ll go and read the whole thing:

The billionaires who ran our paper had capitulated to the billionaires who ran our town, and we couldn’t do anything about it.

Subscribe to The Triad

Three things to read, from JVL.