Why did the Industrial Revolution happen? Why, for the past two centuries, have hundreds of millions of people moved off the farm and into factories?

Stop and think about it for a second. Most people, including myself, will likely pull from some scattered half-remembered facts about the Industrial Revolution from high school: something about enclosures, Eli Whitney, the seed drill. Coursework in undergraduate economics is usually no help—the Solow growth model of Econ 101 only has one sector.

Here’s my quick primer on the textbook neoclassical theory of industrialization: how it can be used to interpret the last 200 years of global economic growth, and—by applying it to the recent rise of China—explore important ways that that theory may be wrong.

You’ll know just enough theory to impress people at parties, for the first time in history someone asks this question. (Thanks will be forwarded on to Professor Andrés Rodríguez-Clare and his Econ 270C module.)

Let’s call “industrialization” growth in the share of the labor force in manufacturing. Neoclassical theory typically thinks of industrialization as the product of two different forces.1

The first is different rates of productivity growth between sectors. This story is probably intuitive for most people: new inventions—the spinning jenny, the steam engine, the iPod Nano—raised productivity in manufacturing more than in agriculture and pulled people out of farms into the factories.

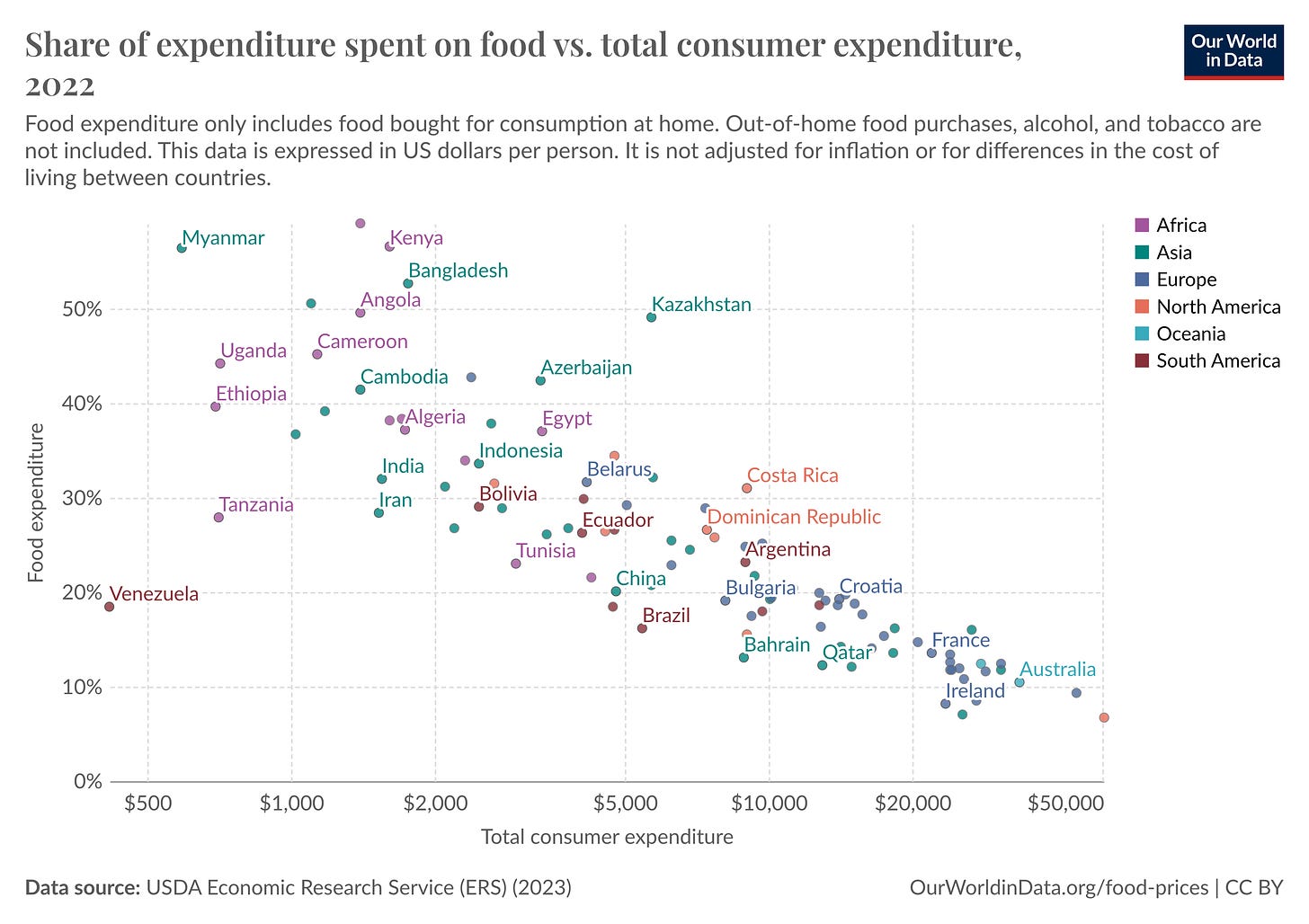

The second, more subtle force is based on the observation that as people get richer, they spend a smaller share of their income on food. This is a phenomenon known as Engel’s Law:2

Engel’s Law (no, not that Engels) implies that any form of productivity growth—even agricultural—can produce industrialization, so long as it raises overall incomes. People can only eat so much; when they get richer, they start demanding stuff other than food, like better housing and clothes. The relative price of these non-agricultural products rises, pushing labor off the farm.

Frankly, I’ve always found the Engel’s Law story somewhat puzzling, as it implies industrialization can happen without any of the scientific and technological inventions typically associated with the Industrial Revolution. But if you stop and think about it, the differential-productivity-growth story is also strange. What pulls people from farms to factories are the higher wages induced by higher manufacturing productivity. But we also have a story of how the Agricultural Revolution preceded the Industrial Revolution: if (say) productivity in agriculture rose faster than in manufacturing, relative agricultural wages should rise and pull people back onto the farm.3

How can we reconcile all these facts?

A solid framework to think through these issues is “Labor Push versus Labor Pull” by Alvarez-Cuadrado and Poschke (2010), who develop the simplest possible model—a closed economy, where labor can move freely between sectors—and take it to data for a set of countries from the 19th century to today.

For non-economists, a useful rule of thumb is that prices and productivity move in opposite directions: all else equal, if we get much more productive at squeezing out lemonade, lemonade prices go down.

Applying this logic to the relative price of manufactures to agriculture (Pm / Pa) helps us learn something about the productivity changes churning underneath:

If the relative price of manufactures to agriculture is falling, manufacturing productivity must be rising faster than agricultural productivity, and “labor pull” is the main story.

If the relative price of manufactures to agriculture rises, the story is a bit more ambiguous.

If the manufactures are growing only weakly more expensive than that of agriculture, then we can’t conclude anything. Because of Engel’s law, productivity growth will weakly push up demand for manufacturing, and the relative price of manufactures, regardless of which sector is growing.

If the price of manufactures is rising much more than that of agriculture, then productivity growth in agriculture is clearly outpacing productivity growth in manufacturing. “Labor push” has to be the main story.

If it helps, you can think of “labor push” very loosely as pushing up the supply of labor, since as incomes grow there’s less need for everyone to be farming;4 and you can similarly think of “labor pull” as pushing up labor demand, since the development of new technologies in manufacturing pulls people to the factories.

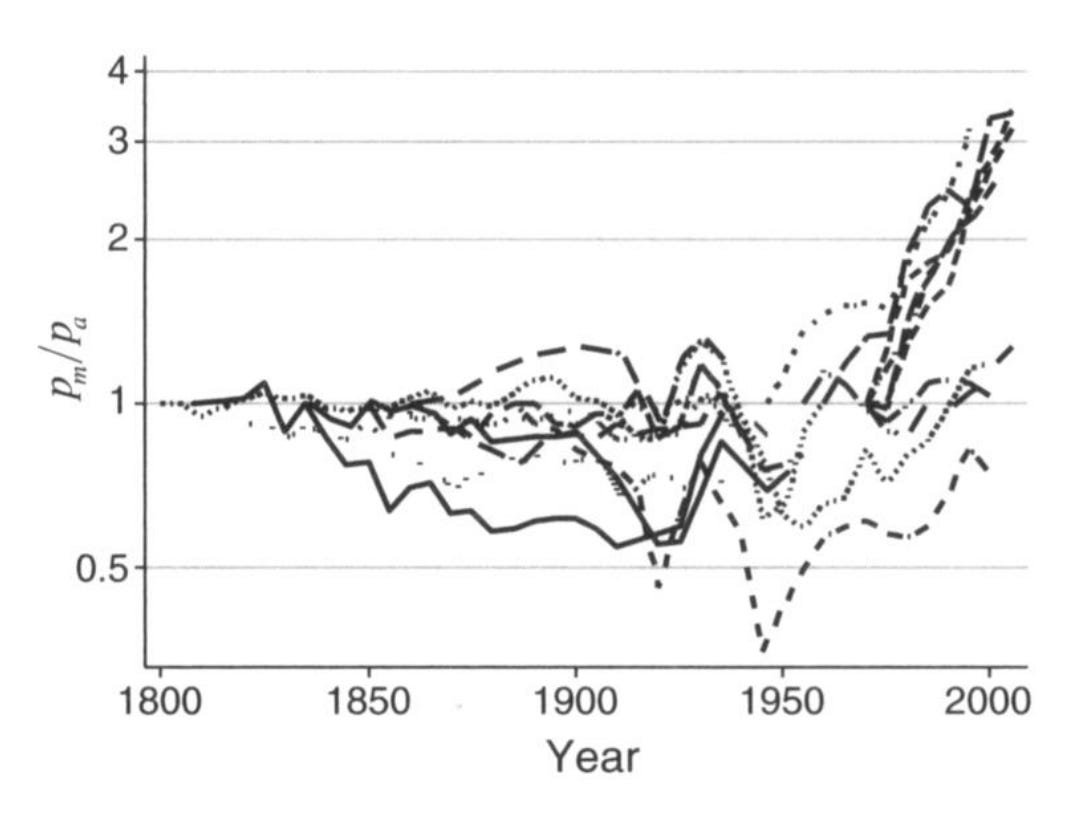

Alvarez-Cuadrado and Poschke take this to the data. They compile price and employment data for manufacturing and agriculture for 12 now-industrialized countries (most of Western Europe plus Canada, the USA, Japan, and South Korea), then examine how the relative prices of manufactures to agriculture evolved throughout the past 200 years:

The relative price of manufactures to agriculture (Pm / Pa) fell for most countries from 1800 until about 1920. Then, after 1920, the price of manufactures started to rise relative to agricultural products.

So, we have two different answers for two different time periods. “Pull” factors dominated throughout the Long Nineteenth Century: manufacturing productivity must have been rising relative to agricultural productivity. Then, after World War II, “push” factors dominated, with general productivity growth causing a shift of labor out of agriculture.

It’s worth pausing here and thinking about the ways this simple model might be wrong. One is the assumption that workers can move freely between sectors, and are paid the marginal product of their labor—a famous man with an enormous beard wrote a long book about this in 1870, and people are still arguing over its implications.

Another is that prices are assumed to be determined entirely within the closed system of the domestic economy. Given the minor phenomenon known as the global trading system, this is unlikely to be true. Kiminori Matsuyama has an elegant 1992 paper showing that, in autarky, agricultural productivity growth has a positive effect on growth—but when the economy is open to trade, agricultural growth has a negative effect. The intuition is that a small developing country that’s open to trade will be forced by the global market into its comparative advantage—which, given its lack of development, will usually be farming.5

(As a quick aside, this model gives a theoretical channel for developmentist industrial policy to work. And it falls out of a standard neoclassical model with limited modification!)

But a third complication, which I’ll focus on in this short piece, is the idea of push and pull as distinct, separable forces.

To make this a bit more concrete, let’s focus on the biggest Industrial Revolution in recent memory: the rise of China. (The macroeconomist Basil Halperin has done several great Twitter threads digging into the Chinese miracle.) A very live question is the extent to which China’s rise was driven by agriculture or manufacturing. This has critical implications for other developing countries—if state resources are limited, which should policymakers prioritize?

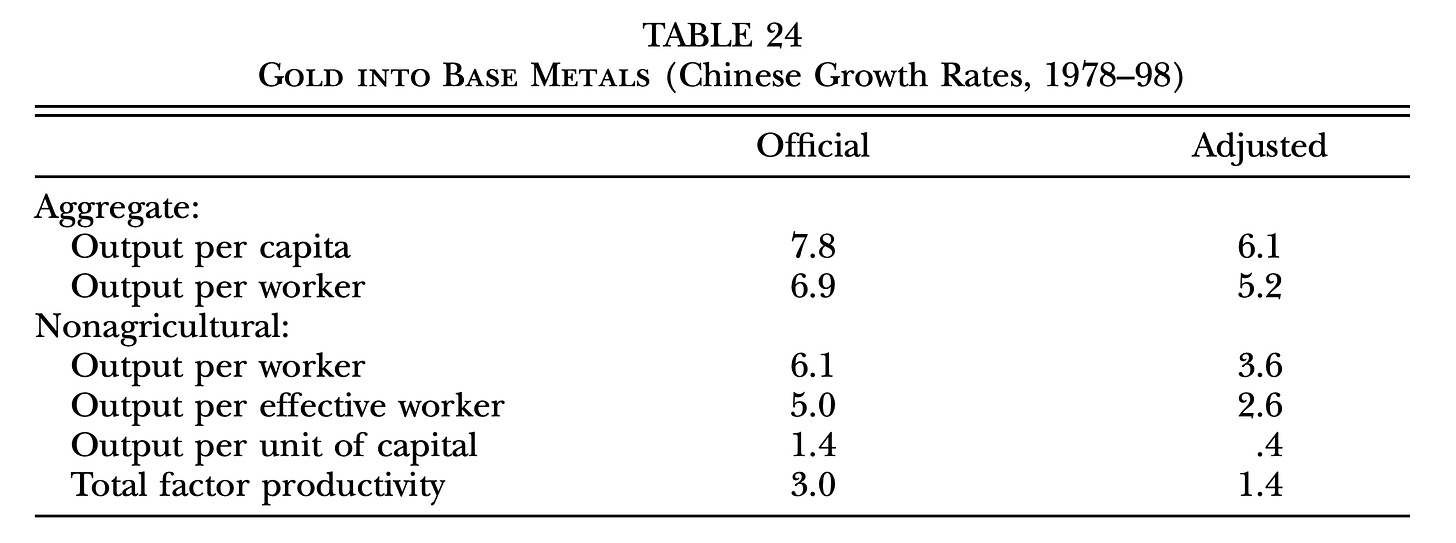

This debate stems from an iconoclastic 2003 paper by Alwyn Young. Young showed that if you account for the enormous quantities of labor that were moving from farms to factories, Chinese non-agricultural productivity growth must have actually been fairly pedestrian, around 1.4% per year:

Think back to the push-pull framework. If all these people were leaving the farms but non-agricultural productivity growth was low, Young’s result implies that the engine of China’s rapid growth must have been in agriculture, not manufacturing.

Not so fast, say Loren Brandt and Xiaodong Zhu in 2010. If you write down a more sophisticated version of the push-pull model, and take the observed rates of productivity growth in each sector as given, then non-agricultural productivity growth must have been the key driver. Without it, China couldn’t have sustained such a massive movement of labor into manufacturing without crashing into severely diminishing returns; if those workers weren’t productive, industrialization wouldn’t have been profitable.

What’s going on? We’ve ping-ponged back and forth between several reasonable-sounding theories. The sleight of hand—one that we’ve implicitly accepted from the start in the “push-pull” framework—is that Brandt and Zhu assume that we can take each sector’s productivity as given. In a more realistic model, the rate of technology growth in a sector is surely shaped by the number of people working in it. If nobody ever left China’s collective farms and joined the cities, then surely the rate of technological growth would drop—there would be fewer scientists, inventors, engineers, entrepreneurs to generate TFP growth in the first place. Incorporating this TFP response would likely shift the burden of explanation back towards whatever was driving people from farming—decollectivization, procurement price reforms, etc.

We’ve come full circle. Separating out Push and Pull was a helpful starting analytical device—but a more accurate model of growth would endogenize the rates of technological progress. Technological development does not fall like Manna from Heaven, but is the organic result of people in each sectors experimenting and inventing; Push and Pull are clasped together, intertwined, inseparable.

Where does this leave us? An elevated sense of confusion: somehow, with more sophisticated modeling, and a head-on confrontation with two centuries of empirical data, we know less than when we started.

If you like this feeling, consider applying to grad school.

Subscribe to Global Developments

Economic development and poverty, past and present.